vermont sales tax on alcohol

To improve lives through tax policies that lead to greater economic growth and opportunity. The Role of Competition in Setting Sales Tax Rates.

While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation.

. ReligiousCharitable Sales Tax Exemption Number N20796. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. X No sales tax on food beverages or retail purchases.

For example evidence. Eleven more states enacted sales tax laws during the 1960s with Vermont as the last in 1969. Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates.

Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxesThis means that the applicable sales tax rate is the same no matter where you are in Massachusetts. Exemption from state sales tax applies to hotel occupancy. The Tax Foundation is the nations leading independent tax policy nonprofit.

Not exempt from USVI hotel occupancy tax. For over 80 years our goal has remained the same. The 2010 health care reform law imposed a 10 percent federal sales tax on indoor.

Some examples of exceptions to the sales tax are. Sales Tax Exemptions in Arizona. Vermont has 19 special sales tax jurisdictions.

In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas such as from cities to suburbs. This page discusses various sales tax exemptions in Arizona.

Only five states currently do not have general sales taxes. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7.

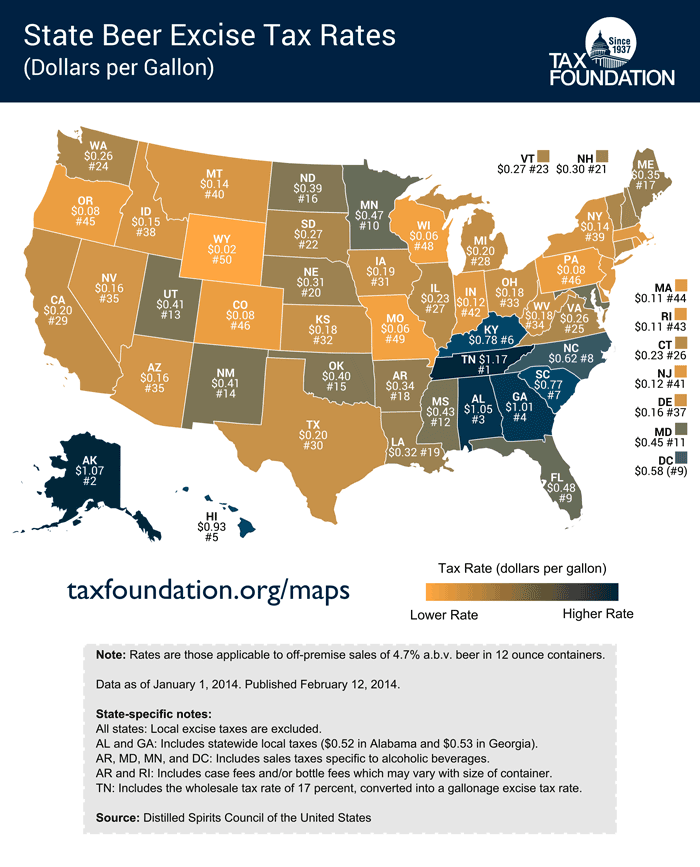

Alaska Delaware Montana New Hampshire and Oregon. Excise taxes applied to a narrow range of products such as gasoline or alcohol. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

These States Have The Highest And Lowest Alcohol Taxes

How To Sell Alcohol Online Delivery Laws In All 50 States 2ndkitchen

Perceptual At Product Category Level Perceptual Map Interesting Questions Alcohol Mixers

Hot White Portable Lcd Digital Breath Alcohol Analyser Breathalyzer Tester Inhaler Alcohol Meters In 2021 Alcohol Tester Breathalyzer Lcd

Are Liquor Stores Open On Thanksgiving 2021

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Antique Bottle Of Glykeron Used To Treat Respiratory Ailments Such As Asthma Old Medicine Bottles Medicine Bottles Vintage Medical

Vintage Amber 7up Syrup Bottle Martin Tenn Near Dyersburg Tn 08 29 2013 Syrup Bottle Bottle Soda Brands

Alcohol Gel Hand Soap Wash Icon Download On Iconfinder Icon Company Icon Gel

Corona Extra Beer Mexican Beer 18 Pack 12 Fl Oz Bottles Walmart Com

Rare 1920s Indian Safety Match Box Penn Cigar Sales Reading Pa Advertising Matchbox Safety Matches Matchbook

Alcohol Taxes On Beer Wine Spirits Federal State

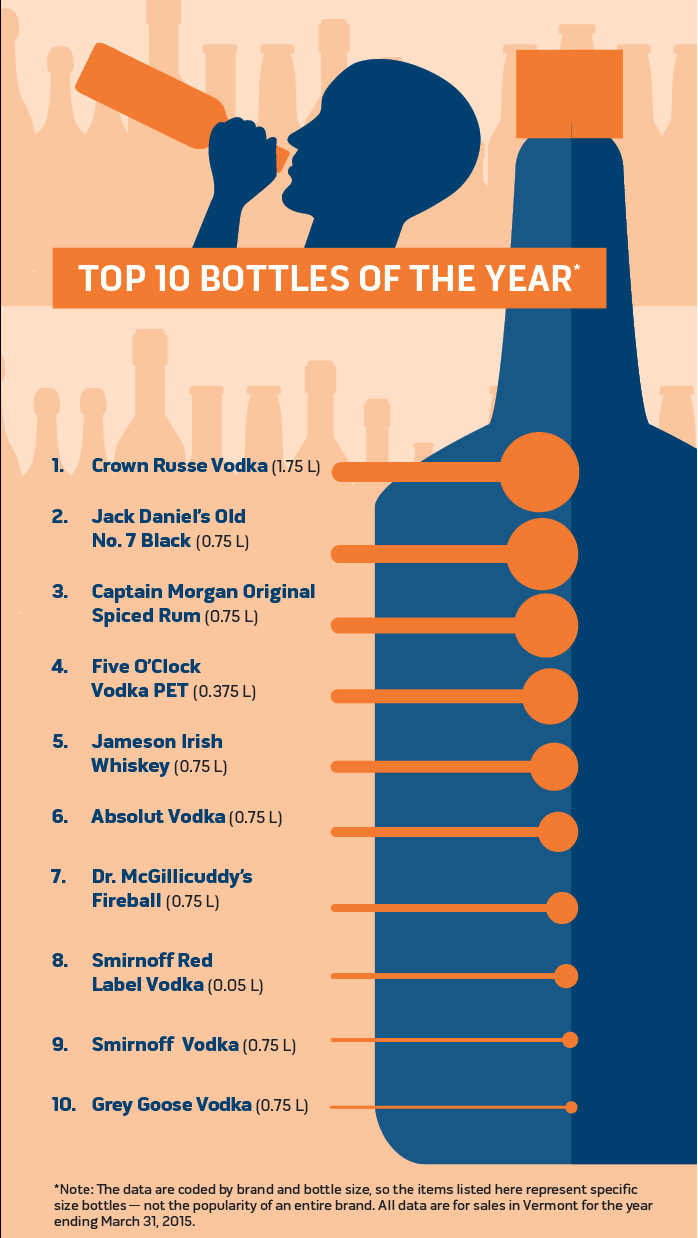

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Palapa Punch Alcoholic Punch Punch Drinks Coconut Rum